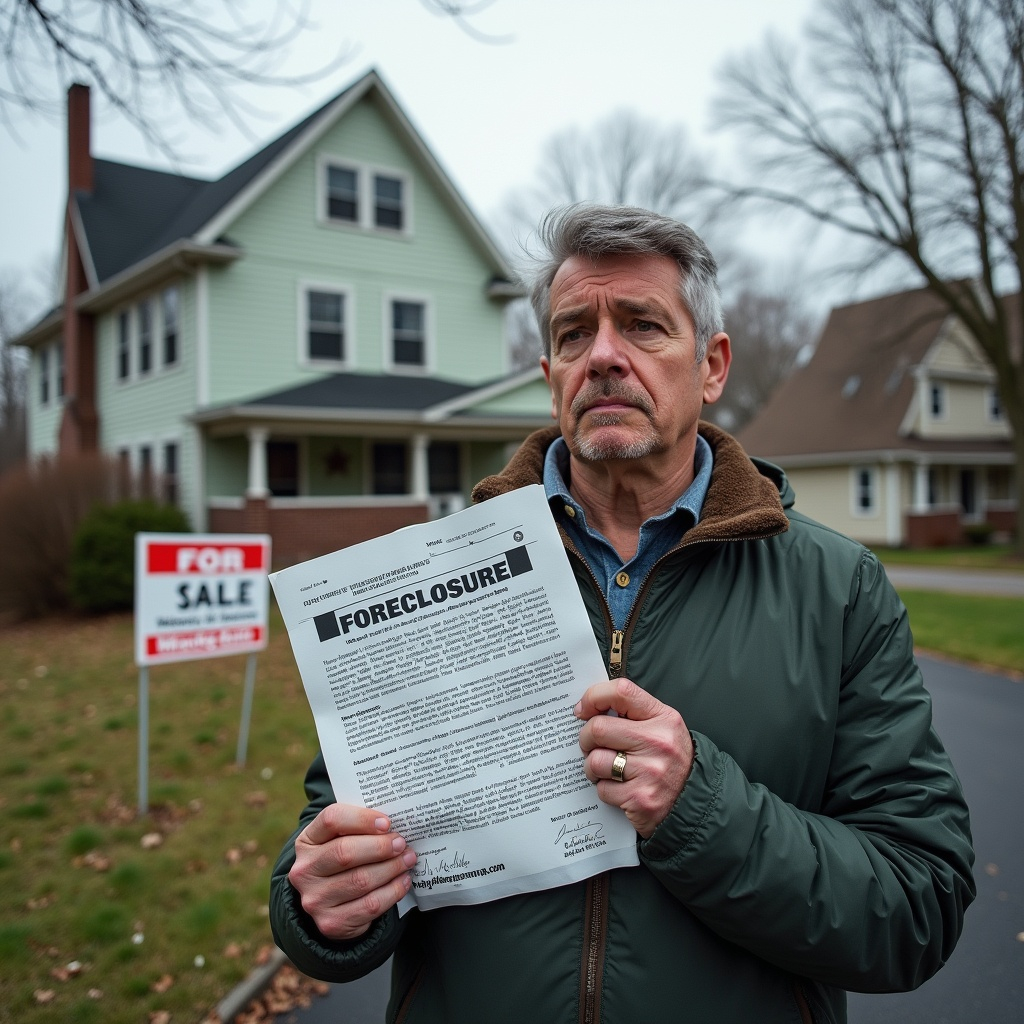

When it comes to Foreclosure Rates in Ohio, both prospective home buyers and current homeowners want to stay ahead of the curve. Whether you’re looking to purchase an affordable property or trying to sell in a market facing rising default risks, understanding how Foreclosure Rates in Ohio affect real estate transactions is critical.

Foreclosure Rates in Ohio: A 2024 Guide for Buyers and Sellers

Foreclosure Rates in Ohio have seen changes over the last few years. When foreclosure rates go up, it can affect everyone—whether you are trying to buy a home, sell a home, or stay in the home you already own. This guide explains it in simple terms and gives tips for buyers, sellers, and homeowners who may need extra help. You will also find resources where you can learn more about Foreclosure Rates in Ohio and see what you can do to avoid losing your home.

1. Foreclosure Rates in Ohio: What Does It Mean?

The term Foreclosure Rate refers to the percentage of homes in the foreclosure process. A foreclosure happens when a homeowner cannot pay the mortgage for a certain amount of time. Once the homeowner misses enough payments, the lender (like a bank) can take legal steps to take back the house and sell it. The foreclosure rate is just a way of tracking how often this is happening in the state.

When rates go up, it means more people are behind on their mortgage payments. This can happen for many reasons, such as job losses or increases in the cost of living. When Foreclosure Rates in Ohio go down, fewer people are losing their homes to the bank.

1.1 Why Should You Care About Foreclosure Rates in Ohio?

- Home Buyers: If you want to buy a home, high Foreclosure Rates in Ohio might mean you can find cheaper houses on the market.

- Home Sellers: If you want to sell, a high foreclosure rate can make your home harder to sell. Buyers may look at foreclosed homes instead, which could sell for lower prices.

- Homeowners: If you are worried about making your payments, it is good to know about programs that can help you.

2. Why Foreclosure Rates in Ohio Are Rising

There are several reasons why rates might go up. Below are some of the most common causes:

2.1 Job Market Problems

When jobs disappear or layoffs become common, many people have less money to pay their mortgages. If they don’t find new work quickly, they might fall behind on their loans.

2.2 Rising Costs

Prices for everyday items like groceries, gas, and utilities have been going up in many parts of the country. When it costs more to feed your family and keep the lights on, you have less money left over for mortgage payments.

2.3 Higher Interest Rates

If you have a loan with an adjustable rate, your payment can grow if interest rates climb. This surprise jump can cause some homeowners to miss payments and end up in foreclosure.

2.4 Ending of Special Programs

In tough times, the government sometimes stops foreclosures temporarily or gives extra help to homeowners. When these programs end, people might lose this safety net. As a result, they can no longer afford their mortgages, which can push Foreclosure Rates in Ohio higher.

3. How Foreclosure Works in Ohio Courts

Ohio uses a judicial foreclosure system. This means a lender has to go through the court to take back a home. Below is a simple breakdown of what happens:

- Missing Payments

If you miss mortgage payments for a set number of months, your lender will send you warnings or notices. - Notice of Default

After several missed payments, the lender issues a Notice of Default. This document officially states that you are behind on your loan and that you could lose your home if you don’t catch up. - Court Filing

Next, the lender files a lawsuit with the county court to start the foreclosure process. You will be served papers, which give you a chance to respond or fix the problem. - Judgment of Foreclosure

If you cannot make a deal with the lender, or if the court rules against you, the court grants a judgment of foreclosure. - Foreclosure Sale

After the judgment, the court arranges a foreclosure sale or auction. Anyone can bid, including investors. If nobody bids high enough, the lender takes ownership of the home. - Redemption Period

Ohio may allow a short redemption period, which is a final chance for you to pay off the debt and stop the foreclosure. However, not all cases offer a long redemption time.

4. How Foreclosure Rates in Ohio Affect Home Buyers

A higher number of Foreclosure Rates in Ohio can mean different things for people who want to buy a home:

4.1 Lower-Priced Homes

Foreclosed homes often sell for less than regular homes. Banks want to get rid of these properties quickly to recover their money. So if you are a buyer, a foreclosure might let you pay less than you would for a similar house sold by a regular homeowner.

4.2 Competition from Investors

Foreclosures attract investors who flip houses or rent them out. These investors might pay cash and make quick offers. If you’re a first-time home buyer, you could find yourself losing a bidding war to all-cash buyers.

4.3 Risk of Repairs

Some foreclosed homes have been empty for a long time or were not taken care of. You might need to pay for major repairs, like fixing a roof or updating plumbing. Always hire a home inspector to find hidden problems. If the home needs big repairs, it might not be such a bargain after all.

5. How Foreclosure Rates in Ohio Affect Home Sellers

If Foreclosure Rates in Ohio rise, people trying to sell homes face extra problems:

5.1 Prices Might Drop

Foreclosed homes in a neighborhood can bring down the sale price of other homes. Appraisers look at local sales when deciding value. If many foreclosed homes are selling for cheap, it can make non-foreclosed homes seem overpriced.

5.2 More Homes on the Market

When foreclosures go up, more properties go on sale. With extra competition, your home might stay on the market for a longer time, unless you lower the price or make your property stand out with upgrades.

5.3 Buyer Views

Buyers may worry that an area with lots of foreclosures is not stable or is losing value. This might discourage them from making offers. You might need to spend money on repairs or remodeling to set your home apart.

6. Ways to Prevent Foreclosure in Ohio

If you are struggling to pay your mortgage, it’s important to act fast so you do not become part of Foreclosure Rates in Ohio. Here are some steps to consider:

6.1 Talk to Your Lender

Many homeowners wait too long before contacting their lenders. Lenders often have programs to help people who are behind on payments. They might change the terms of your loan or let you skip payments for a short time. But you have to ask.

6.2 Loan Modifications

A loan modification changes the terms of your mortgage so your payments become more affordable. This might include lowering the interest rate, extending the length of the loan, or adding missed payments to the end of the loan.

6.3 Forbearance

A forbearance lets you pause or reduce your mortgage payments for a set period. This can help if you lost your job or had high medical bills. When the forbearance ends, you’ll have to catch up on the missed payments, so plan carefully.

6.4 Selling Before Foreclosure

If you can’t pay what you owe and are unlikely to recover, selling your home might be better than letting it go into foreclosure. If you still have equity in your home, you could walk away with some money and protect your credit score from a full foreclosure mark.

7. Programs That Help Lower Foreclosure Rates in Ohio

Because Foreclosure Rates in Ohio affect the whole state, there are government and private programs to help homeowners stay in their houses. Below are a few major types of help:

7.1 Federal Resources

The U.S. Department of Housing and Urban Development (HUD) has many tips, tools, and counseling services. They can direct you to local programs in Ohio that assist with mortgage problems. HUD-approved housing counselors can also offer guidance if you are behind on your loan.

7.2 Ohio Department of Commerce

At the state level, the Ohio Department of Commerce oversees financial rules for lenders and can provide education on how to manage your mortgage. This group often works with homeowners and banks to reduce Foreclosure Rates in Ohio.

7.3 Private Loan Programs

Some banks and credit unions have special refinancing or loan modification deals. These are aimed at lowering monthly payments for homeowners in trouble. Ask your lender if they have any programs for people who cannot make payments.

7.4 Nonprofit Groups

Nonprofits and community organizations sometimes hold workshops to teach budgeting and give legal help. They can also refer you to local housing counselors. With the right plan, you may avoid falling into foreclosure and keep your home.

8. Finding Deals at Foreclosure Auctions in Ohio

When Foreclosure Rates in Ohio increase, it can mean more homes for sale at auctions. These auctions often happen at a county courthouse or online. Investors and home buyers both attend, hoping to buy houses for less than market value. However, buying at a foreclosure auction has its risks:

8.1 Benefits of Buying Foreclosures

- Lower Purchase Price: Auctioned homes can sell for less than other properties on the market.

- Fewer Steps: In some cases, auctions can be a faster way to buy a home than a traditional sale.

8.2 Risks of Auction Properties

- No Inspection Access: Many auctions don’t let you inspect the home before bidding, so you could find out later that the house needs expensive repairs.

- As-Is Condition: The home is usually sold “as-is,” meaning you are responsible for fixing everything that is wrong.

- Needed Cash or Hard Money Loans: Lenders often do not give standard mortgages for auction purchases, so you may need cash or a short-term “hard money loan” to buy.

8.3 Doing Your Homework

- Check Property Records: Look for tax liens or judgments that could become your problem if you buy the home.

- Drive By: If possible, look at the outside of the property. While you might not see the inside, an exterior check can reveal major red flags.

- Set a Budget: Auctions can be exciting, but don’t get into a bidding war without a firm limit.

9. What’s Next for Foreclosure Rates in Ohio?

Nobody knows for sure what will happen in the future, but experts watch several trends to guess where Foreclosure Rates in Ohio might go:

9.1 Economy and Jobs

If Ohio’s industries, like manufacturing or healthcare, start hiring more people, homeowners may find it easier to keep up with payments. If jobs are hard to find, Foreclosure Rates in Ohio might keep rising.

9.2 Interest Rate Changes

The Federal Reserve decides whether interest rates go up or down. If interest rates stay high, some homeowners with adjustable-rate mortgages could find their monthly payments too big. This could lead to more foreclosures.

9.3 Government Support

State or federal leaders might pass new rules to protect homeowners or give them more time to catch up on payments. If these programs expand, Foreclosure Rates in Ohio could slow down, at least for a while.

9.4 Housing Demand

If more people move into Ohio cities, home demand could stay strong, helping owners sell quickly if they can’t pay their mortgage. But if people move away from certain areas, it could become harder to sell, and foreclosure numbers might grow in those spots.

10. Main Points About Foreclosure Rates in Ohio

- Foreclosure Rates in Ohio measure how many houses are going through the foreclosure process.

- Rising foreclosure rates can hurt local home prices and make it tougher for people to sell homes.

- If you are a buyer, higher Foreclosure Rates in Ohio could mean more chances to find cheaper homes, but you may face tough competition and possible repair costs.

- If you are a homeowner, act quickly if you miss payments. Talk to your lender about ways to avoid foreclosure, such as a loan modification or forbearance.

- Many programs at both the state and federal level aim to help people stay in their homes. Nonprofit groups can also give free advice or legal help.

- Foreclosure auctions can be a way to buy homes below market value, but be careful. Some properties need costly repairs, and you might need cash to bid.

- Future Foreclosure Rates in Ohio will depend on job growth, interest rates, and local government help.

11. Helpful Websites

Here are three websites with more information on Foreclosure Rates in Ohio and ways to avoid losing your home:

- U.S. Department of Housing and Urban Development (HUD)

What You’ll Find: HUD has guides, phone numbers, and links to housing counselors who can help if you’re behind on mortgage payments. - Ohio Department of Commerce

What You’ll Find: Learn about state rules on lending and foreclosure, plus get tips on protecting your home in tough times. - Consumer Financial Protection Bureau’s Mortgage Guide

What You’ll Find: Advice on loan types, refinancing, and what to do if you can’t afford your mortgage.

Final Thoughts

Foreclosure Rates in Ohio matter to everyone who owns a home or wants to buy or sell a home. If more people lose their homes, it can lower housing prices, make it harder to sell, and increase the number of discounted, distressed properties. Buyers can sometimes find deals, but they must watch out for repairs and investor competition.

If you own a home and face money problems, the best step is to speak with your lender right away. Foreclosure is stressful, but there are ways to prevent it or at least make the process smoother. Knowing about loan modifications, forbearance, or government aid can help you stay in control and avoid losing your house.

In the end, Foreclosure Rates in Ohio will likely change based on job growth, local industry, and how the government responds to economic challenges. By staying informed, you can take advantage of chances in the market (if you’re a buyer) or find help if you’re worried about missing your mortgage payments. Keeping an eye on rates is important for protecting your home or finding the best deal on a new property.

Next Door Properties is here to offer solutions. We can help homeowners sell before the foreclosure process begins. We can also help foreclosure buyers by finding properties and facilitating deals. To learn more about us and what we can offer don’t hesitate to reach out! We’re happy to answer any questions you have about foreclosure properties in Ohio. (860) 398-4472

![companies that buy houses [market_city]](https://image-cdn.carrot.com/uploads/sites/74456/2024/08/Company-That-Buys-Houses.webp)